Uzbek issuers primed for primary market after NMMC prints tight to sovereign

George Collard, Francesca Young – May 08, 2025 07:52 PM

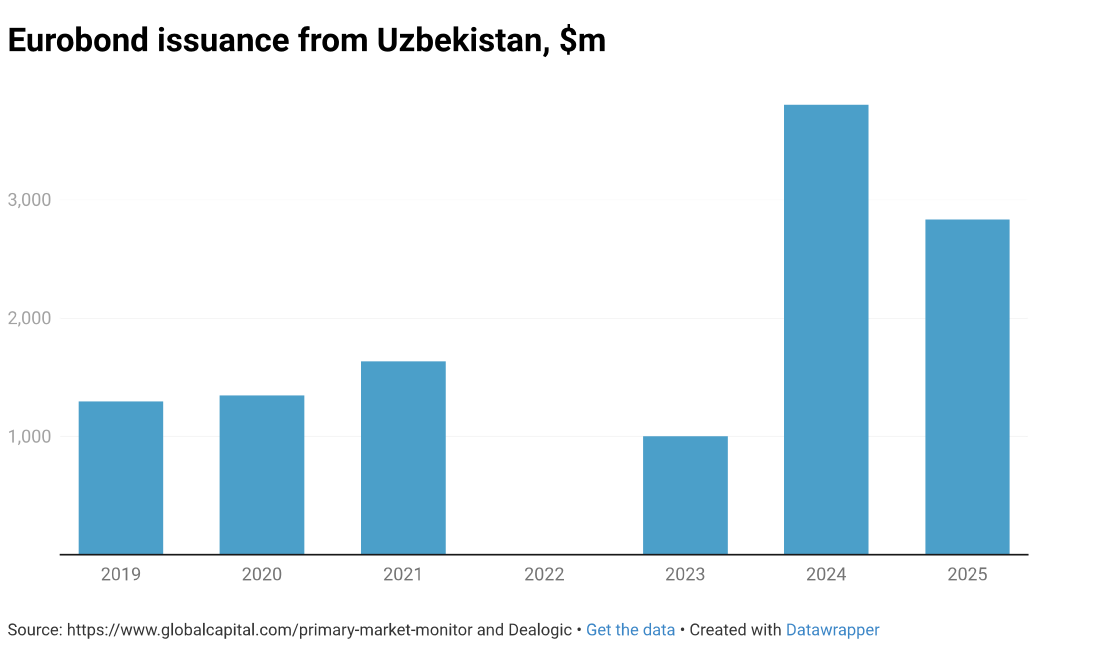

Volumes from the country are nearing record levels just five months into the year

More bond issuers from Uzbekistan are circling the primary market after a super tight print from gold mining giant Navoi Mining and Metallurgical Company on Wednesday – and it will not take many more deals in 2025 for it to become a new record for volumes from the country in one year.

State-owned NMMC sold $500m of 6.75% 2030s, pricing on the same day as an interest rate decision from the US Federal Reserve. It was a move that took “some bravery”, said a banker involved, but one that he said paid off.

Issuance from Uzbekistan is on track to be at record levels in 2025. There have been $2.4bn of new bonds so far this year, or $2.8bn including a som tranche sold overseas by the sovereign in February, following NMMC’s trade. The busiest year since the sovereign debuted in 2019 was 2024, at $3.8bn, according to Dealogic.

Several Uzbek issuers are expected to print new bonds this year, which could mean this year's volumes surpass those of 2024.

“There is at least one more corporate coming in June,” said a debt capital markets banker who worked on NMMC’s trade. “There is another looking for post-summer, and expect two FIG deals by the year end, at least.”

Three companies have maturities in the next 12 months, one state-owned bank, one private bank and a corporate, and they are obvious candidates for issuance.

Like many Eurobond issuers, those from Uzbekistan stayed out of the primary market in 2022 either because they could not issue, or did not want to pay the prices required. Since the sovereign ended that drought in October 2023, new bonds from the country have drawn high demand.

Two EM sovereign fund managers said on Thursday that Uzbekistan is a “good story”, and that investors are attracted by the higher spreads on offer from most state-owned issuers versus the sovereign, although NMMC is not one of those, having priced flat to or even inside the sovereign curve.

“It’s a good story from the sovereign perspective,” said a London-based EM fund manager. “And leveraging up the government-related entity sector is a nice value proposition for investors.”

Issuers lining up

Likely candidates for issuance from Uzbekistan are those companies or banks with maturities coming up.

There are two of those this year, according to Dealogic. The first is on October 21, $300m 4.85% paper from the National Bank of Uzbekistan, a state-owned entity.

The other is the Ipoteka Bank $300m 5.5% bonds due on November 19. Ipoteka is part of Hungary’s OTP Bank, a regular bond issuer.

In addition, there is a $300m 4.85% bond from UzAuto Motors maturing in May, and GlobalCapital understands that the company has put out a request-for-proposals from investment banks. But plans are at an early stage and issuance may not come until 2026.

The pipeline of bonds is regulated by the finance ministry, which has to give the green light to any bond issuance in the country.

“The ministry looks at the market situation and conditions and the levels required, and many other things, before giving the green light to any corporates or banks to issue bonds,” said a source involved in NMMC’s trade.

“I’d expect more, if not in the first half, then in the second half,” said another DCM banker who worked on NMMC’s trade. “It took a bit of bravery to go out on an FOMC day but it worked well.”

The second EM sovereign fund manager in London expected more trades from Uzbekistan, although said some will be too small for his fund to get involved.

“The markets have opened again for the quasi-sovereigns and corporates,” he said. “I can see some banks taking advantage, too. But the issuance from Uzbekistan is small, and some is not big enough for funds like us to get involved, but I can see capital markets activity.”

A sovereign trade in October 2023 marked the return of Uzbek issuers to primary after an absence of two years.

Since then, five non-sovereign issuers have printed: NBU, Uzbek Industrial and Construction Bank (SQB), Agrobank, Uzbekneftegaz and NMMC (twice), but only the last two have sold trades of $500m or more – preventing some investors from taking part.

Uzbek attraction

The credit ratings of state-owned issuers like NMMC are constrained by the sovereign rating, which is BB-/BB- with stable outlooks from S&P and Fitch.

But the credit quality of an issuer like NMMC is illustrated by its standalone credit profile of BB+/BB+, two notches above its credit ratings and just one notch off investment grade.

Fitch gave three factors that could lead to an upgrade for the sovereign, in its most recent credit rating update last August: the consistent implementation of structural reforms, durable fiscal consolidation and sustained improvement in governance.

“It’s just got very good features,” said the first London-based investor. “It has some strong industries, be it mining or banking, and growth is doing well. Inflation is under control and the central bank is very prudent and reserves are very strong. I can see a rating upgrade on the horizon, and maybe it’s not too far fetched for them to get investment grade ratings at some point.”

S&P predicted that GDP will grow on average a “strong” 5.6% a year between 2024 and 2027 in a November rating update.

Inflation was 10.3% year-on-year in March, according to the Central Bank of Uzbekistan, up from 8% in March 2024 but lower than the 12% and higher rates for much of 2022.

“All in all it’s just a country going through reforms and doing the right thing,” the investor continued, highlighting the government’s privatisation programme as attractive for investors. “They’re trying to clean up balance sheets and diversify the economy, and they have strong remittance flows.”

Another attraction for the second London-based EM investor was the number of sustainable projects in the country, meaning it gets strong multilateral support.

“It’s a darling of multilaterals,” he said. “We’ve generally stayed out of sovereign issuance because it’s too tight for the rating, but it continues to get support from the multilaterals and it’s on a positive trajectory.”

“Uzbekistan has credit quality and stability,” said the second DCM banker. “It’s stable and hasn’t been much affected by [the US tariff plans]. It’s predictable and easy to read.”

NMMC goes tight

NMMC printed $500m 6.75% 2030 bonds at par on Wednesday, its second visit to the primary markets after a $1bn dual trancher in October 2024 which drew a big book. Initial price talk on Wednesday had been at a yield of 7.375% area, and a book of $2.3bn at final terms allowed it to shed 62.5bp off that initial pricing to reach 6.75%.

According to GlobalCapital’s Primary Market Monitor, that is the most tightening by an Uzbek issuer since they came back to primary at the end of 2023, beating the 55bp on each tranche in NMMC’s debut in October.

The tight pricing did mean a large drop in the order book, which ended at over $1.3bn.

“Initial price talk was so cheap,” said the first EM fund manager. “It seemed like a no-brainer, but at the end they left very little on the table. But the bonds are around reoffer [at midday London time] which speaks for a fair price point, so a good job by the syndicates, although it makes it less interesting for the investor.”

NMMC had set the size at $500m from the outset, which the second DCM banker involved said gave it “the luxury” of being more aggressive on pricing.

“When you fix one parameter from the start [size] then you have just price left,” he said. “And the decision was made to be as aggressive as possible, but to still maintain the quality of the book, and that was there. It was well distributed between the US, the UK and Europe.”

The second EM investor thought that it priced at about fair value on a spread basis, which was 285bp over US Treasuries.

“That level of tightening seems to be the standard in Uzbekistan,” he said. “They always start high. The book closed at $1.3bn which is still pretty strong, but it shows investors were price conscious.”

NMMC priced inside the sovereign curve, said the banker involved, or at worst, flat.

“That makes sense,” said the second EM fund manager, “because of the significant gold reserves of the company, which are crazy, they're significant.”

The firm’s mineral resources are 146m ounces – by comparison in 2024, it produced 3.1m ounces of gold – and its life of mine is over three decades.

NMMC is in the top four gold miners in the world by production. Muruntau, the biggest open pit gold mine in the world, makes up about 70% of its output, according to Fitch.

NMMC trades well above over another CEEMEA gold miner, South Africa’s AngloGold Ashanti, said the second EM investor. AngloGold has a credit rating of Baa3/BB+/BBB- and has $700m 3.75% 2030s at 140bp over Treasuries, 145bp inside NMMC.

But NMMC’s revenue is above AngloGold’s, at $7.4bn in 2024 versus $5.8bn, and earnings are higher, he pointed out.

“It has a lower gold price break, too, and similar leverage,” he added. “But the geography and sovereign set the tone for the ratings. It won’t get there easily, but NMMC could get to 100bp or lower versus AngloGold.”

“It all looks pretty good with NMMC,” added the first investor. “It’s got low leverage and is a leading gold producer and is one of the biggest taxpayers in Uzbekistan.”

Source: GlobalCapital